Economy

GRA to replace TIN with Ghana card identification number

Effective April 1, 2021, taxpayers will be required to use the Ghana Card Identification Number for tax purposes.

This is according to the Ghana Revenue Authority, GRA.

The Authority states that this forms part of efforts to identify and rope in more eligible taxpayers, especially those in the informal sector and enable organizations to easily share important data with the Authority.

This also forms part of measures being implemented by the GRA to achieve its 60 billion Ghana Cedi 2021 revenue target of the Ghana Revenue Authority.

Speaking at a press briefing in Accra, Commissioner-General of the GRA, Rev. Ammishaddai Owusu-Amoah explained that the Authority is already in collaboration with the National Identification Authority, NIA, and other relevant stakeholders to ensure that the Ghana card Unique Identification Number replaces the Taxpayer Identification Number (TIN).

“In order to be able to achieve this target, we have started some initiatives. We are working with the NIA and by March we would be replacing individuals’ TIN with their Ghana Card identification number. We are in collaboration the NIA and other relevant stakeholders are working to ensure that with effect from 1st April the Ghana Card become the unique Identification number for both the NIA and for your TIN,” he said.

Tax payers will therefore be required to use the Ghana Card Identity number for tax purposes as well this replacement of Identification will enable the organizations share important data and also will help identify and also rope in more eligible taxpayers,” he added.

Rev. Ammishaddai Owusu-Amoah also noted that the GRA, has also employed data scientists to analyse the transactions of high-net-worth individuals (HNWI) – persons with around US$1 million in liquid financial assets –to ensure that they are paying the right taxes to government.

He said the GRA has configured and synchronised its data with 14 other government institutions, including the Driver and Vehicle Licensing Authority (DVLA) and the Social Security and National Insurance Trust (SSNIT) to enable them achieve this.

We are looking at data analytics. We have recruited data scientists and data analytic officers. These data analytical officers will be receiving data from about 14 institutions. They will be analysing it and through the data analysis, we will be able to identify people that are non-compliant taxpayers and make them complain.

Read also: MTN modifies tariffs, gives more bonus

“In other words, for example, if we do analytics, and we find out that you are using a latest Mercedes Benz from the data we gather from DVLA and your tax is GH¢50, automatically the system will tell you there is something wrong here, and we have to look further to see whatever it is, and before you realize it, we will come to you and say we don’t think you are paying the right taxes,” Rev. Owusu-Amoah said.

-

Business1 week ago

Business1 week agoQNET Triumphs at PR Awards 2024 with Three Prestigious Wins

-

Business4 days ago

Business4 days agoLagos State Officials Praise Jospong Group’s Eco-friendly Waste Management Module, Eyes Similar Module

-

General News2 weeks ago

General News2 weeks agoMawuena Trebarh passes on at 52

-

Entertainment4 weeks ago

Entertainment4 weeks agoMassive turnout at MTN SIW in Kumasi, ACP Kofi Sarpong lauds organisers

-

AgriBusiness3 weeks ago

AgriBusiness3 weeks agoAfrica’s Agrifood Entrepreneurs Called to Action: Applications Open for the US$100,000 GoGettaz Agripreneur Prize Competition

-

Technology3 weeks ago

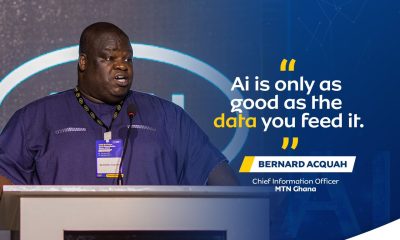

Technology3 weeks ago“AI is about partnerships, collaboration not replacement” -Bernard Acquah

-

Company/Corporate News3 weeks ago

Company/Corporate News3 weeks agoQNET engages Stakeholders to mark 2024 World Health Day

-

Education2 weeks ago

Education2 weeks agoUCC Council Chairman Creates Commotion Over Appointment of Registrar And Director of Human Resources