Ghana is set to begin mining its lithium deposits once Atlantic Lithium Ltd’s Ewoyaa Lithium Project’s first mine comes online next year.

A mining concession has been granted to Australia’s Atlantic Lithium Ltd which has partnered some locals via a Joint Venture (JV) to exploit the rich lithium deposits in the Ewoyaa (Mankessim) area of the Central region.

In 2018, Ghana’s discovery of lithium in commercial quantities was widely publicised to the excitement of many stakeholders.

With further exploration ongoing, lithium deposits have been discovered in the Central, Western and Volta regions thus far. Lithium is a rare earth mineral that has gained prominence in recent times owing to the critical role it plays in the growing electric vehicle (EV) revolution which relies on lithium-ion (Li-ion) batteries.

Hence, Li-ion batteries will be more in demand as mobile electronic devices such as smartphones, tablets, laptops and other wearable devices proliferate with growing access to the Internet.

For a country with a long history of natural resource extraction dating back to pre-colonial times, (gold, bauxite, manganese, diamonds etc) the discovery of lithium came as a welcome surprise.

Ghana’s proven 180,000 tonnes of lithium reserves rank the country fourth place on the African continent behind DR Congo (3,000,000 tons), Mali (840,000 tons) and Zimbabwe(690,000 tons).

It is projected that Ghana will generate about $4.8 billion over the life of the mine (LOM) based on a five per cent carried interest in the project.

The carried interest of five per cent is similar to Government’s interest in other decades-old mineral mining agreement which have failed to yield notable benefits to the state or surrounding communities thus far.

Atlantic Lithium has obtained an exploration licence for the project, which gives the mining company access to 139.23 square km of the lithium-rich site.

The project comprises deposits in Ewoyaa, Abonko and Kaampakrom approximately 100km south-west of Ghana’s capital Accra.

The project was initially estimated to hold 18.9 million tonnes of probable petalite and spodumene ore grading of 1.24 per cent lithium oxide (Li2O) containing 109 kilotonnes of lithium (109,000 tonnes) metal as of March 2022.

Atlantic Lithium’s latest mineral resource estimate for the project, however, suggests the lithium deposit in the area is up to 30.1million tonnes grading at 0.26 per cent lithiumoxide.

Two million tons are expected to be mined annually, which implies that Ghana’s lithium deposit would be completely exhausted in about twelve years if more discoveries are not made.

Countries around the world are adopting the G7 goal of cutting greenhouse gases by 40 per cent to 70 per cent by 2050 from 2010 levels and phasing out the use of fossil fuels by the end of the century.

To achieve this, a two-pronged approach consisting of progressive legislation on one hand and incentivisation of electric automobile manufacturers via subsidies on the other hand has been implemented.

Significant subsidies for electric vehicles have resulted in the success of EV manufacturers Tesla and more recently China’s BYD.

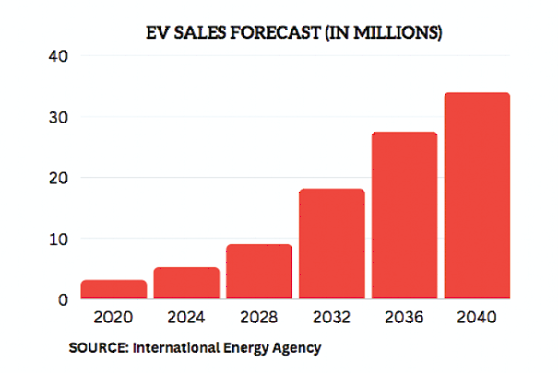

The exponential growth in EVsales as shown in the chart below attests to the rapid rate of adoption of viable electric substitutes for petrol-fuelled cars such that tech giants Apple and Google are preparing to enter the fray with smart electric vehicles.

For perspective, 30 countries committed to stop the sale of new petroleum and diesel car models by 2040 at the COP26 conference in 2021.

China, which is the largest vehicle consumer market, has launched an aggressive policy to reach a target of 75 per cent of all new car sales being electric by 2030.

With sweeping policy changes such as these, the energy transition case which shows more than 60 per cent of global energy consumed being from renewable sources by 2050 is more likely to unfold.

According to the IEA, demand for lithium could grow to more than 40 times current levels if the world is to meet its Paris Agreement goals.

By 2040, Mackenzie estimates that the world will need 800,000 tons of lithium per annum for car battery production alone.

The strategic importance of lithium can therefore reasonably be expected to grow in lockstep with prices due to demand outstripping supply as the global electric vehicle market explodes.

These altogether indicate that lithium producing countries and lithium-ion battery manufacturers are set to earn billions from lithium mines and battery factories for the next two decades at least, all other things being equal.It is against this backdrop that Ghana’s strategic positioning as regards the exploitation of its lithium deposits deserves scrutiny.

In the International Energy Agency’s Global EV Outlook published last year, sales of EVs doubled to 6.6m units in 2021 from the previous year.

The total number of electric cars on the roads globally reached 16.5m, tripling from the quantity estimated in 2018. In the first quarter of 2022, 2 million EVs were sold, up 75 per cent year-over-year (YOY).

Consequently, world wide lithium production in 2022 increased by 21 per cent to approximately 130,000 tons from 100,000 tons in 2021 in response to strong demand from the lithium-ion battery market and increased prices of lithium. Global consumption of lithium in 2022 was estimated to be 134,000 tons, a 41 per cent increase from 95,000 tons in 2021.

The IEA estimated global lithium carbonate (LCE) output to increase slightly above demand to 650,000 tonnes for 2022 and 1.47 million tonnes for 2027.

Wood Mackenzie forecasts that global cumulative lithium-ion battery capacity could rise over five-fold from 2021 figures to 5,500 gigawatt-hour (GWh) by 2030 in response to massive EVexpansion plans.

Mackenzie also estimates that EVs will be responsible for over 80.0 per cent of global lithium demand by 2030 as they replace the estimated 1.45 billion petrol cars worldwide.

The price of lithium has grown exponentially since the introduction of lithium-ion electric vehicle batteries in 2017 rising from US$ 9,100 to US$ 19,000 per ton in January 2023.

Other uses of lithium include pharmaceutical use, production of alloys, fuel, desiccant, glass, ceramics and automotive parts to name a few.

In 2012, the automotive sector accounted for 14 per cent of the Li-ion battery market. By the end of 2016, this had grown to as much as 25 per cent and presently exceeds 50 per cent.

In terms of legislation, landmark policy decisions around the world include the EU’s recent complete ban on diesel and petrol cars by 2040 and the commitment of major automobile manufacturers such as Toyota to produce hybrid and fully electric vehicles only by 2030.

The rapid adoption of electric cars in developed economies has informed the policy shift in Western countries and China to gradually phase out fossil fuel-powered vehicles.

It is projected that Ghana will generate about $4.8 billion over the life of the mine (LOM) based on a five per cent carried interest in the Project.

The carried interest of five per cent is similar to Government’s interest in other decades-old mineral mining agreements which have failed to yield notable benefits to the State or surrounding communities thus far.

According to the US Geological Survey, at the current rate of global production, proven reserves may be exhausted in about 135 years if demand remains the same.

In the more likely scenario of accelerating demand, proven reserves would be exhausted in less than 50 years.

The lithium value chain consists of mining companies, refineries and downstream electronics manufacturers.

A considerable amount of value is added at the processing and manufacturing stages where lithium carbonate, lithium hydroxide and other lithium compounds are derived for endstage manufacturers who primarily make lithium-ion batteries as well as other products like pharmaceuticals.

Some lithium rich countries such as China and the US have opted to participate in the value chain mainly at the refinery and manufacturer level thereby maximising value from domestic lithium extraction.

The alternative is to take the path of least resistance as Ghana and some African countries such as Congo are doing by carrying on business-as-usual with mining and exporting spodumene/petaliteore.

Under the Atlantis lithium Deal, lithium- containing petalite and spodumene ore will be mined and exported, a continuation of a model that has denied the country value from its precious minerals such as gold, diamond and bauxite.

The government’s policy orientation towards resource extraction without value addition has made Ghana a net loser in the extractive industry.

The laws governing the extractive industry grant the government of Ghana a maximum 10 per cent carried interest in the rights and obligations of mineral operations at no cost.

The government is free to participate further in any mineral operation subject to agreement with the mining company (rights holder).

Moreover, the Ministry of Lands and Natural Resources may require mining companies to issue special shares to the Republic for no consideration.

The rights accompanying the special shares shall be agreed upon between the mining company and the Ministry of Lands and Natural Resources.

It is therefore puzzling why government has not made moves to increase its stake beyond the initial allotment in any of the extractive industries to date.

GNPC’s recent move to acquire the Pecan oilfield is commendable, however, increasing the state’s stakes in the goldmining and emerging lithium industry may prove to be equally profitable ventures requiring less upfront financial investment.

Lack of transparency on some critical aspects of Atlantic Lithium’s mining concession (i.e. legal ownership of the lithium deposits, identity and shareholding of the indigenous Joint Venture partners of Atlantic Lithium Ltd, the 10-year tax break period granted Atlantic Lithium given the expected Life of Mine (LOM) being ~12.5 years, local content stipulations for skill transfer and capacity building (if any).

Failure to develop a comprehensive, modern framework to guide the nascent industry to maximise long-term value for the country.

Failure to position the country as a viable location for manufacturing of downstream lithium compounds and or lithium-ion batteries countries such as Nigeria, Mexico and Bolivia have applied novel approaches to lithium extraction for strategic reasons.

According to a news article published by The Nation, Nigeria recently rejected a bid by American electric car company, Tesla, to mine raw lithium in the country because it did not want foreign companies to mine natural resources without value addition via processing.

In a similar vein, Mexico has recently declared its lithium deposits as a strategic national resource and therefore prohibited private investment in the extraction of lithium.

The government of Mexico cited the growing importance of the rare element vis-à-vis exploding demand as lithium is poised to be the “new oil” of the energy transition in coming decades.

If we must limit the role Ghana will play in the emerging green economy to lithium ore extraction and export, it is imperative that we maximise returns to the State by negotiating more significant carried and participating interest.

The example of Bolivia which successfully negotiated royalties of about 11 per cent in addition to a majority (51 per cent) stake in its lithium mines (49 per cent belongs to the concessionaire/operator) in 2019 is worth investigating.

After 133 years of gold exports, Ghana has neither a functioning gold refinery nor economic development directly traceable to gold export receipts.

Even the major mining communities of Obuasi, Prestea and Tarkwa do not reflect any of the wealth produced from gold mining.

If Ghana is going to realise lasting benefit from its extractive sector there is the need to increase the State’s equity in these assets.

GNPC’s planned acquisition of the Pecan Oil Field represents a move in the right direction. However, there are many reasons to take advantage of the novelty of the lithium opportunity to secure a bigger piece of the pie which is bound to grow larger.

The government must explore creative financing mechanisms that would enable us to own these assets while attracting technical expertise without sacrificing our interest in these assets for want of expertise.

An option is to bring on board regional development banks such as the ECOWAS Bank for Investment and Development (EBID) for financing once the case is made for lithium as a high-potential strategic national asset.

Alternatively, the state can bring on board lithium mining companies as strategic partners to provide the technical expertise either solely as contractor or as minority shareholder.

In the spirit of this turnaround in national policy positioning with regard to the extractive sector, the government should take advantage of the nascent state of the lithium mining industry to secure a significant stake (30 per cent min.) in pipeline mining operations.

The need to move away from the paltry carried interest approach towards declaring such discoveries as strategic national assets like Mexico has done cannot be overemphasised.

The time to strike is now as lithium supply security has become a top priority for technology companies in Asia, Europe and North America.

Strategic alliances and joint ventures among technology companies and exploration companies are being established to ensure a reliable, diversified supply of lithium for battery suppliers and vehicle manufacturers.

In addition to significant ownership going forward, Government acting through the Trade ministry should approach major manufacturers of a wide range of downstream lithium compounds and lithium-ion batteries in particular to lobby for a plant to be sited in Ghana.

The Lithium mined in Ewoyaa would be feedstock for the battery plant.

This way, the more valuable Li-ion batteries would be exported instead of ore. Given the unreliability of critical inputs such as power and transportation infrastructure, Government may have to incentivise battery manufacturers with tax holidays, reserved power supply and perhaps concessions on standard local content requirements for a while to sweeten the deal.

The government could also emulate the Australian government’s effort to build refining facilities close to its lithium mines.

This will ensure value addition and diversification of Ghana’s role in the global lithium supply chain.

The resulting long-term benefits would include GDP growth, employment, skill transfer and capacity building, development of related industries and most importantly evolution of the Ghanaian economy away from mere natural resource extraction.

Electric vehicle demand growth could be Ghana’s chance to launch phase 2 of the industrialisation drive dubbed “1D1F”.

Ghana would be uniquely positioned to attract EV manufacturers such as Tesla and BYD looking to establish a regional presence as a result of a pre-existing ecosystem and its attendant economies.

Significant value addition through the production of the technology and not just the natural resource would signify the maturation of our industrial sector and readiness for industrialisation.