This is per data released by the Central Bank on the country’s oil revenue performance within the first half of 2022,

Despite the significant decline in returns on the GHF, some $6.36m in interest income or returns was realised from the Fund.

This compares to the $8.64m interest returns on the GHF recorded same period last year – H1 2021.

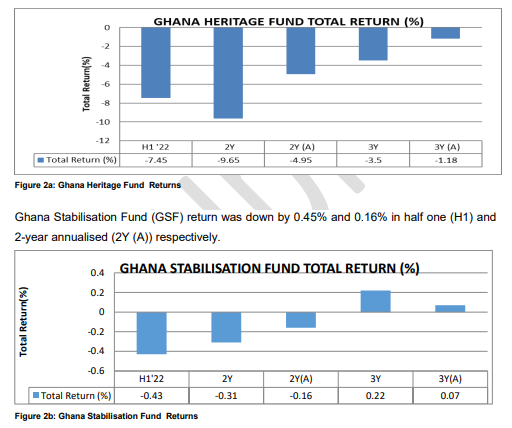

For the, Ghana Stabilisation Fund (GSF), interest returns also declined marginally by 0.43% within the review period.

Realised income from the GSF was $0.77m. Total interest returns on both the GHF and GSF was $7.13m.

“In H1 2022, the Ghana Petroleum Funds returned a net realised income of US$7.13 million compared to US$8.74 million in H1 2021. The Ghana Stabilisation Fund contributed 10.77% or US$0.77 million to total net income compared to US$0.10 million in H1 2021 whilst GHF contributed 89.23% or US$6.36 million compared to US$8.64 million in H1 2021.

“The GPFs reserves at the end of H1 2022 was US$1,223.70 million (GHF was US$849.91 million and GSF was US$373.79 million) compared to US$815.29 million in H1 2021 (GHF was US$676.45 million and GSF was US$138.84 million),” noted the Central Bank.

Ghana earns $731.9m in crude oil receipts for H1 2022

Meanwhile, Ghana earned $731.9 million from crude oil receipts in the first half of this year, the Ghana Petroleum Funds report has revealed.

Out of it, $544.61 million was realised from crude oil liftings in the first five months of 2022.

$186.3 million was however secured from corporate tax paid by the oil producing companies including Tullow, Kosmos and Petro Sa.

$992.3 million was obtained from surface rental and interest from the Petroleum Holding Fund.

For the crude oil liftings, $108.8 million and $104.1 million which were the biggest earnings were secured from liftings on March 6th, 2022 (Ninth SGN) and March 26th, 2022 (sixty-fifth Jubilee) respectively.

With regard to surface rental, AGM Petroleum Gh paid the highest tax of $174,100, followed by Aker with $150,750.