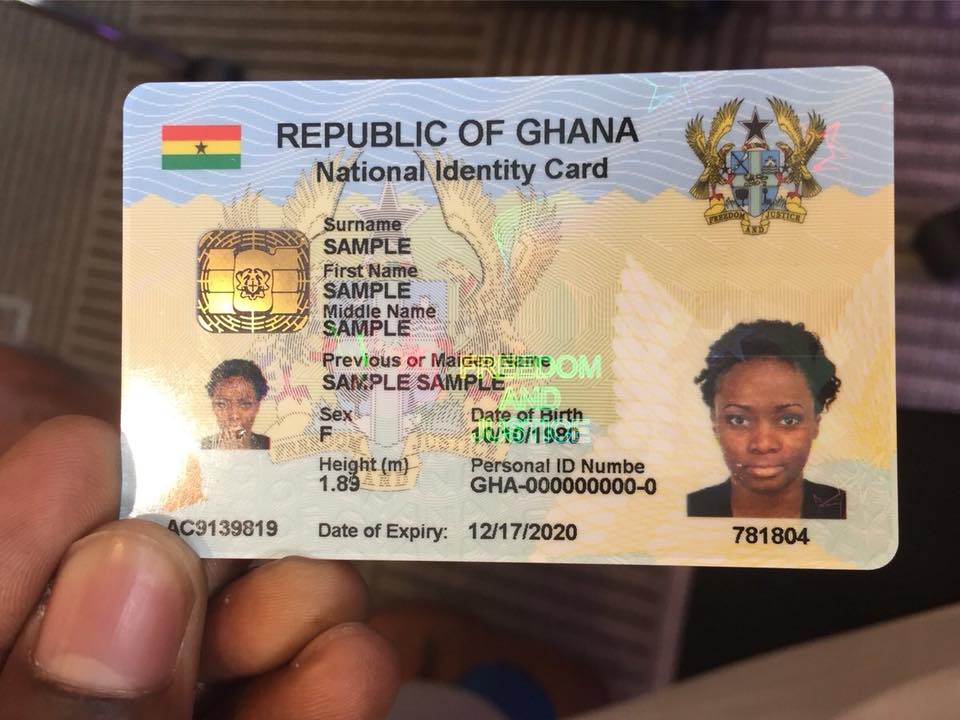

Banks have expressed their readiness to comply with a Bank of Ghana (BoG) directive that mandates them to use only the Ghana Card in identifying their customers before transacting business with them.

The Ghana Association of Bankers (GAB) said the July 1 deadline was favourable and they would take the necessary steps to enable them to comply.

The Chief Executive Officer of the GAB, John Awuah, told the Daily Graphic yesterday that banks had been working with the National Identification Authority (NIA) and its private partner to link their systems to the National Identity Register for the purposes of verification.

Consequently, he expressed the confidence that the processes would be completed by June to allow for its take off in July.

Directive

He was reacting to a public notice from the central bank to banks and other deposit-taking institutions to accept only the Ghana Card as a form of identification in undertaking transactions from July 1, this year.

The central bank also directed the affected institutions to take steps to update their customer records using the Ghana card details as the only form of identification.

The directive issued yesterday and signed by the bank’s Secretary, Ms Sandra Thompson, said the move was to ensure the safety of the financial system.

The public is to note that no other form of identification will be accepted for financial transactions in all BoG-regulated financial institutions after the effective date stated above,” the notice stressed.

It explained that the directive applied to banks, specialized deposit-taking institutions (SDIs) non-deposit-taking financial institutions, payment service providers and dedicated electronic money issuers, forex bureaus and credit reference bureaus.

Read also: BoG, Giesecke+Devrient to pilot first CBDC in Africa

ID register

The bank said the directive was pursuant to Regulation on the National Identity Register, 2012 (L.I. 2111).

In line with this Notice, Section 30 of the Anti-Money Laundering Act, 2020 (Act 1044) and Regulation 12 of the Anti-Money Laundering Regulations, 2011 (L.I. 1987), all financial institutions shall take steps to update customer records with the Ghana card. Customers of BoG regulated financial institutions are, therefore, advised to update their records with their respective financial institutions with the Ghana Card in line with this notice,” the statement said.

KYC

It explained that the NIA verification transaction platform would be integrated into the BoG’s financial monitoring platform for the purposes of know your customer (KYC).

This is to ensure that all financial transactions performed within the ecosystem are linked to one identity and information, and unique codes for the transactions shared with BoG to facilitate the identification of initiators/beneficiaries for track and trace purposes. This will include but not limited to transactions by banks, non-bank financial institutions, and mobile money operators (MMOs).

Compliance

Awuah said banks had been in constant discussion with the central bank, the NIA and the private partner on how to make the Ghana card the only medium to identify customers.

He explained that banks were working to connect their systems with the national register to ensure that whenever customers came to the banking halls for transactions, their Ghana cards could be verified.

What it means is that between now and July 1, customers will have to walk in to the banking halls and replace their identity documents with only the Ghana card. For those who do not replace their cards before the July 1 deadline, they will have to do so before they can be served,” he said.

Source: Daily Graphic