The Ghana Chamber of Mines (GCM) has projected that the country’s gold output is expected to increase to between of 2.9 million ounces to 3 million ounces by the end of this year.

Also, production of manganese is expected to increase to about 5 million tonnes in 2022.

Speaking at a media workshop with members of the Journalists for Business Advocacy (JBA), the Research and Analysis Manager of GCM, Chris Nyarko, said “In 2022, we expect most of the mines to operate at a steady-state level and with everything being equal we expect gold production for this year to be between 2.9m and 3m ounces.”

In 2021, Ghana recorded a string of steep declines in the outturns of production and purchases of its traditional minerals, with manganese and diamond being the sole outliers. This caused the country to lose its number one position as gold producer to South Africa.

The volume of gold attributable to producers in Ghana declined from 4.022 million ounces in 2020 to 2.818 million ounces in 2021, representing a downturn of 29.92%. The output level in 2021 was the lowest since 2008.

The fall in production was due to a combination of concurrent reductions in the output of both large and small-scale gold producers.

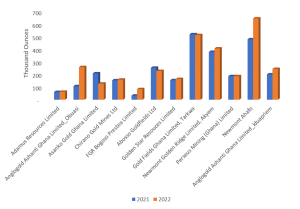

The large-scale sub-sector’s contribution to national gold production decreased from 2.847 million ounces in 2020 to 2.720 million ounces in 2021. This translated into a reduction of 4.44%. The descent in the sub-sector’s output was primarily explained by a broad decline in the output of most mines.

The year-on-year output of Adamus Resources, Asanko Gold Mines, as well as AngloGold Ashanti’s Obuasi and Iduapriem Mines reduced by more than 10%.

The main moderating influence on the drop in production was the expansion in output of Abosso Goldfields.

Again, total production attributed to small-scale producers declined from 1.175 million ounces in 2020 to 98,001 ounces in 2021, representing a fall of 91.66%.

The near-collapse in the sub-sector’s official output was driven principally by the imposition of a withholding tax (WHT) on gold exports.

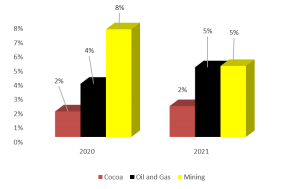

Despite its negative growth rate, the mining sector outperforms the other main export sectors in terms of gross value added and contribution to GDP. The mining sector share of export contribution in GDP in 2021 was 5% which was at par with oil and gas (5%) as against the 2% recorded by cocoa. In 2020 however, the mining sector share of export contribution in GDP was 8% whiles that of oil and gas was 4% and gold was 2%.