In a candid pre-budget conversation on Joy FM on Wednesday, Prof Peter Quartey, the Director of the Institute of Statistical, Social, and Economic Research (ISSER), unveiled a noteworthy 58% deviation from the E-levy revenue target.

This revelation comes on the heels of ISSER’s recent report, released on October 31, 2023, dissecting the efficacy of the E-levy and prompting critical reflections on the optimal tax rate for digital transactions.

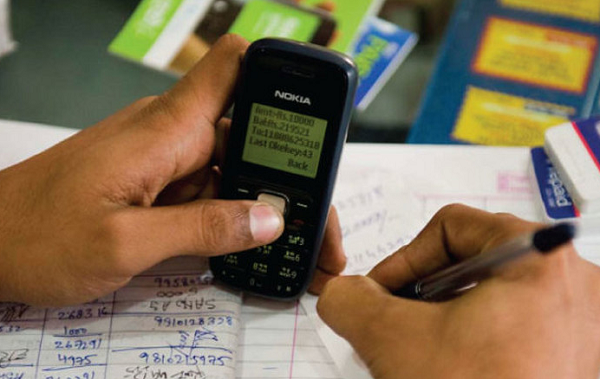

The ISSER report sheds light on the impact of the E-levy rate adjustment from 1.5% to 1% in January 2023. Initially, the reduction led to a dip in the usage of alternate payment systems. However, the figures rebounded sharply in February, suggesting a potentially short-lived effect of the rate modification.

The report delves into broader implications, extending its analysis beyond Ghana to offer a global perspective on tax policies. It underscores a recurring theme – in several countries studied, projected tax revenues failed to materialize, emphasizing the imperative of optimizing tax rates.

ISSER’s findings serve as a vital resource for policymakers, urging a reassessment of the E-levy rate to strike a balance between revenue generation and sustaining consumer participation in taxable transactions.

Professor Quartey during the discussion expressed unease about the absence of real-time data, a hurdle impeding academics from offering well-informed recommendations for effective policy implementation.

This underscores the challenges inherent in navigating the dynamic landscape of digital taxation and underscores the pressing need for timely and accurate data to shape informed policy decisions.