Barring a last-minute change to plans, Ghana will formally announce its intent to default on its debt early next week.

This was revealed in high-level meetings between the country’s authorities and top finance and economic sector actors on Friday, the 2nd of December 2022, as the country’s senior men’s football team battled the Uruguayans for World Cup glory.

Regular readers of this site will recall our earlier mention of the authorities’ intent to have a “shallow restructuring” of the country’s debt and our assessment of any such approach being unlikely to make a serious dent in the macrofiscal situation. After hiring four international consulting firms, and crunching the numbers more soberly, the government seems to have come around to the reality that a somewhat deeper restructuring is required.

Driven by a strong compulsion to fast-track its impending IMF program, the government appears also to be backtracking on earlier commitments to design a “market-led” debt treatment strategy. Financial sector actors report that the tone of the authorities during Friday’s initial engagement was not one of delegating the strategy formulation for the proposed “debt exchange” to the Ghana Association of Banks, securities and dealers, and other such industry groupings. The government is determined to drive the process.

The Finance Minister expressed fears of Ghana being shut out of the international capital markets for the next three years. Consequently, the strategy is to aggressively revive relationships with bilateral donors (like the UK, US, Germany, France, China etc.) and multilateral institutions (like the World Bank, African Development Bank, etc.) in order to attract more cheap money in the form of grants and other concessional types of financing. Doing this, he reckons, would require a “stamp of approval” from the IMF.

It is thus the government’s strategy to quicken the tempo of meeting any prior actions the IMF formally imposes once the government submits its Letter of Intent for a Fund program hopefully this month. The seeming haste in powering through the debt restructuring stems from this factor.

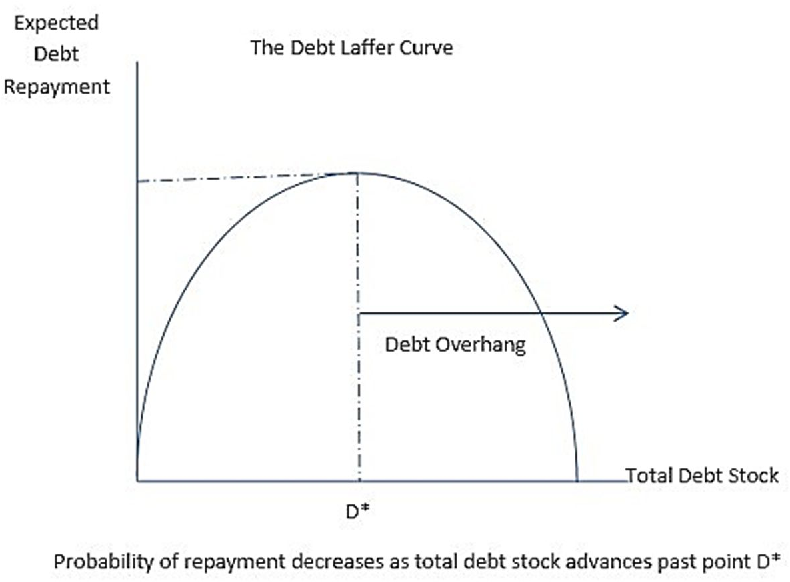

The Finance Minister’s Technical Advisors disclosed at a high level results of an internal debt sustainability analysis which confirms long-held views on this site that Ghana’s debt is not sustainable under realistic fiscal conditions over the medium term. In fact, subject to stress testing, even a consistent series of low or zero fiscal deficits may not be able to bring the debt onto a sustainable path in the next 10 years. On both solvency and liquidity grounds, debt treatment (some kind of default) is now unavoidable and inevitable in any scheme to make Ghana’s debt bearable without permanently damaging the economy.

Given that Ghana’s debt carrying capacity is of medium calibre, debt sustainability requires that debt-to-GDP ratio be brought down from the current level of more than 100% to 55%. The debt service ratio (how much of government income is spent on paying interest and repaying principal) must likewise be brought down from over 60% to a more prudential 18% level.

In the view of the Technical Advisors, tackling the fiscal deficit alone will bring down debt-to-GDP to a still high 85% to 90% range, when the prudential target is 55%. It will moreover require an “extreme adjustment” involving successive primary surpluses in a country that has only seen such surpluses 3 times in non-consecutive years in the course of the last 30 odd years. The growth implications of such an extreme fiscal adjustment would be dire in a developing country where government spending is highly stimulative. In short, a complete non-starter.

Faced with these strong constraints, the government is compelled to take difficult decisions on the debt stock. To stay true to a political preference for avoiding “principal haircuts” (i.e. failing to repay part of the debt) in the domestic context, the decision has been taken, as far as the local debt is concerned, to instead have steep coupon discounts. In simple terms, if the government can’t repudiate a part of the domestic debt, then it will heavily reduce the interest it pays on it and how long it takes to pay through various techniques.

The Finance Ministry concedes that using coupon discounts alone will not bring the actual domestic debt stock down, and thus will not enhance solvency. Coupon cuts and tenure extensions are merely “partial support”, but they will nonetheless bring much-needed short-term liquidity relief (reduce the year-to-year stress on the government from having to pay very high interest rates in a time of financial distress). It follows then that some of the “support” for lowering the total debt stock simply has to be found from principal haircuts on the foreign debt (in simple terms, Ghana will not pay back all the external debt it owes). More on that later.

On the domestic front, the government’s plan is to recall all the bonds and other debt securities it has issued, with the exception of treasury bills, and return to investors new bonds with new terms (the technical term is creating “exit bonds”). Because the existing bonds are too “fragmented” (many and diverse), the government will consolidate. After the restructuring, there will be only 4 types of local bonds with different maturity and interest terms.

The maturity profiles (when repayment will be due) of the four bonds will be 2027, 2029, 2032 and 2037, with an average weighted life of 10 years.

The local debt stock will be split among the four exit bonds as follows:

2027 – 17%

2029 – 17%

2032 – 25%

2037 – 41%

That is to say, regardless when the original bonds an investor held were due to mature, they will now be exchanged for new bonds that will mature according to the above timelines.

As part of the trade-off for not cutting the face value of local debt, the government will freeze principal repayments of the local debt but not necessarily that of the external debt. All local bonds due for repayment will simply be rolled over in line with the new maturity terms.

The 2027 bonds will see principal repayments made in two equal instalments in 2026 and 2027. The 2029 bonds will be repaid in two tranches in 2028 and 2029. The 2032 bonds, on the other hand, because of their size, will have a three year repayment schedule starting in 2029. The 2037 bonds will see repayment over a five year period. In all cases, interest payments will fall linearly in proportion to the principal amortisation rate.

The transformation aimed for is one of a constant linear payout rate on local bonds from 2026 onwards, in effect phase-shifting the burden on government away from the present to the post-2026 horizon. The government is of the view that such a model creates predictability to the benefit of the financial sector.

Regarding interest payments, the authorities intend to pay no (zero) interest across all bonds in 2023. In 2024, it intends to pay 5% interest. And in 2025, the interest rate will increase to 10% and stay constant across all bonds till the last bundle matures in 2037. Readers may put this in perspective by comparing the current average weighted interest rate of more than 21% per annum.

To reiterate, these measures are expected to only bring the key solvency indicator, debt-to-GDP, down to 85% from the current 100% plus level (the latest IMANI estimate is 108% without Sinohydro obligations and contingency liabilities emanating from the energy, cocoa and roads sectors).

And now to the most controversial part. The government intends for these measures to apply equally to the entire domestic debt stock, except for treasury bills. No discrimination is envisaged for the debt secured through special vehicles like ESLA and Daakye or those issued locally but in USD, or even the so-called “Templeton bonds”. The only nuance involved is that the spreading of these “special” government debt obligations across the four exit bonds will follow a certain order and pattern.

No mention was made of government debt that are not in the form of marketable securities. Supplier/contractor debts, bank loans and various overdrafts were not touched on at all in the deliberations.

To pacify the clearly traumatised audience, the Finance Ministry gurus dangled the benefits of a quick IMF program and accelerated return to stable macrofiscals. They projected a likely drop in inflation (and potentially interest rates) to single digits resulting in positive real returns on the new exit bonds.

The government pledged to double down on liability management, including a fastidious commitment to improved sinking fund management to ensure that come 2026, the government will be in a position to resume servicing debt at an elevated level. Some industry observers are worried of a repeat restructuring as was the case in Jamaica in 2013.

Some vague assurances were given by the government about special measures being introduced to ensure limited or zero negative spillovers into the financial sector as a result of the debt restructuring program. Somewhat more tangibly, the government discussed the prospect of a new liquidity fund that will help financial sector players in dealing with a sudden upsurge in redemption requests (customers trying to pull out their money from the financial system).

The possibility of loosening some prudential ratios related to liquidity, leverage, risk-weighting of assets and capital adequacy was mulled without any concrete commitments. Regulatory forbearance was however affirmed, especially in relation to minimum capital, asset class limits and the standardisation of the accounting treatment of revalued bonds. Pension Funds were consoled with news of upcoming support measures to mitigate against mounting redemption risks.

No information was provided about the moral hazard implications of all this regulatory laxity in the trusteeship process, among others.

As hinted above, the President’s premature commitment to “no principal haircuts” was not tenable when given. The authorities are now trying to manage the fallout by shifting the burden of adjustment to external debt and deepening coupon discounts. Our understanding is that the government will offer external debt holders the following terms: a 30% principal haircut, a 30% coupon haircut and a three-year moratorium (or standstill) on interest payments.

Chart: Oshua (2018)

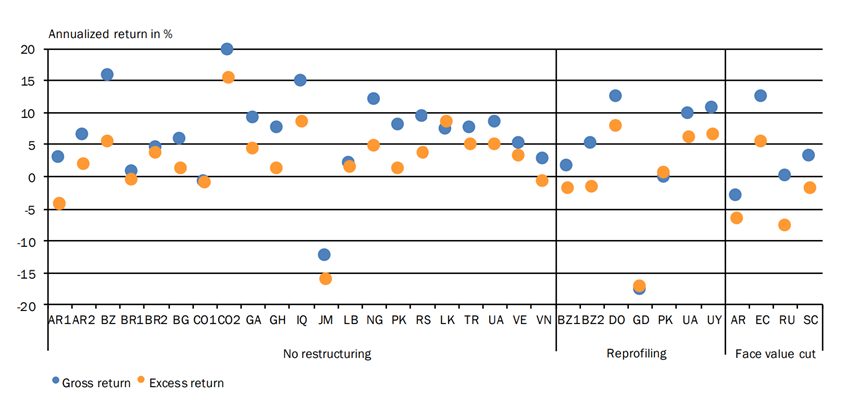

This essay is much too brief to delve into the differential impacts of the different debt exchange models politically available to Ghana and their resulting effects on different classes of investors. The academic, technical, policy and professional literature on that subject is very vast. On the whole, however, it is safe to say that Ghana’s current “opening gambit” proposals tilt enough to the “higher loss” end of the spectrum for a large enough group of investors to trigger some banding-up resistance soon after the announcement.

Julian Schumacher (2019)

So where does all this lead to as far as the short-term dynamics of Ghana’s economic crisis are concerned? We have not heard enough to update our previous analysis, though we suspect that the occasion to do some of that will arise in coming days. For now we will reiterate our standing assessments:

- Consistent with the government’s posture, “stakeholder consultations” will remain perfunctory. No serious attempt has been made to mobilise major factions of the society behind these plans. Not even the ruling party is fully briefed about the entire strategy set of the authorities.

- The Opposition Party in Parliament is not sufficiently primed to play a major role in these developments. The frontbench has not shown any clear signals of pushing any detailed alternative policies. There are some concerns that the leadership is fickle and unsteady. Impending internal primaries have also weakened Opposition Party leaders and distracted some Members of Parliament.

- That notwithstanding, the government’s strong inclination to entirely ignore Parliament has serious risks.

- Civil Society actors, including the unions, have yet to develop anything remotely like a united front, Still, the complete disinterest in “meaningful engagement” with these groups on the part of the authorities will create negative conditions in the information environment. The lack of an “elite position” on the planned measures will result in a highly discordant public conversation with massive amounts of misinformation being generated without significant counter. The principal religious bodies and others, seen as more sympathetic to this government, for instance, are in no position to credibly calm waters.

- We reiterate our earlier position that, next to poor stakeholder mobilisation, the biggest risk to the proposals is litigation, including the possibility of class actions inspired by political opposition actors and unions. Some of the local debt instruments are subject to English law, heightening the prospect of some holdouts being facilitated by the use of the London courts to frustrate the government’s timeline. Some other local debt instruments are overcollateralised by tax revenue and may become the subject of domestic litigation.

- We have suggested in the past that a Greece-style law may have been helpful in moderating litigation risks but the government’s preferred timeline for action and disinterest in meaningfully engaging the Opposition has apparently ruled this out for now.

It is important to bear in mind that these are merely the government’s initial proposals. Haste has been the foremost consideration in coming up with them. The rubber however meets the road in the rough and tumble of the democratic process. Some of the risk factors indicated above can only be resolved by strategic backpedaling by the government with perfect timing.

The true quality of the Ghanaian government would be seen in how it sequences and orchestrates its concessions, whilst holding its red lines, as it navigates the process post-announcement.

Whilst the underlying technical appraisals guiding its actions are reasonably thorough, I am afraid I do not have too much confidence in the government’s mastery of the political economy of crisis management.