Of all the motley crew of ideas the government of Ghana has churned out in recent days and weeks to deal with the country’s deteriorating public finances, none has caught fire like the decision to start buying oil with gold rather than dollars.

Everyone from crypto-anarchists to goldbugs is doing cartwheels trying to chip in their two cents about how the move contributes to the long-awaited demise of the petrodollar system.

The government of Ghana has professed two goals:

Reduce the pressure on the local currency – the Ghanaian Cedi (GHS) – caused by large fuel importers’ perennial search for US dollars to bring in fuel from overseas. In the government’s new model, the country will buy locally produced gold in local currency and exchange the gold for fuel produced in the Gulf or elsewhere.

By removing the dollar input into local pricing, it aims to offset the effects of the alarming depreciation of the Cedi on retail fuel prices, and thus moderate price rises at the pump. That is to say, if the dollar exchange rate is no longer a factor in how wholesale prices are set, then they won’t factor into retail prices either, and the breakneck depreciation of the Cedi won’t be passed through into final prices paid by consumers.

Are these hopes valid? Is the programme even feasible at all?

As for technical feasibility, there is no doubt that it is feasible. After all, Ghana is hardly the first country to mull this idea.

As far back as the 70s, major oil exporters in the Gulf initially responded to the Nixon shock (the jettisoning of the “gold standard” by the US that led to gold prices rising from $35 to $455 by the close of the decade) by broaching the idea of being paid with gold directly. That is if the US was no longer going to back the dollar with gold (i.e. redeem the dollar with gold on demand), then, the oil exporters argued, they might as well just take gold as payment for their wares.

In the event, the Gulf-based oil exporters abandoned this stance and opted to instigate oil “price shocks” instead. Within three years the price of oil went from $3 to $12 a barrel.

An even earlier case study of the gold-oil barter phenomenon would be the use of Philadelphia-minted gold coins by American oil explorers to pay royalties in Saudi Arabia in the 1940s.

More recently, between 2011 and 2012, India and Iran explored the use of gold as a payment for Iran’s sanctioned oil. Iran in fact tried to scale the program internationally but failed to find enough takers. Turkish brokers and government intermediaries however dug in until, in 2016, Reza Zarrab, a Turkish banker with vast regional networks, was arrested in New York by the American authorities for money laundering and sanctions-busting.

From then on, gold-oil barter schemes became too closely associated with the shadowy underbellies of global finance and commodity trading. Reza’s fate would give more fodder to the cottage industry of conspiracies about the West, especially America, being hellbent on preventing gold-based commodity trades. The internet today is awash with all manner of theories about how Libya’s Gaddafi was “taken out” for trying to switch from the petrodollar system to a gold-backed dinar-based trading system.

The murkiness notwithstanding, the technical viability of trading oil in gold is not really in doubt. In fact, there are reports of Emirati, Kuwaiti and Omani refineries and oil traders already reaching out to the Ghanaian government to explore the prospect.

The real issue is whether even should a deal be successfully struck with Gulf or Asian traders, any resulting transactions will lead to the attainment of the two goals described above. Here, I am somewhat doubtful.

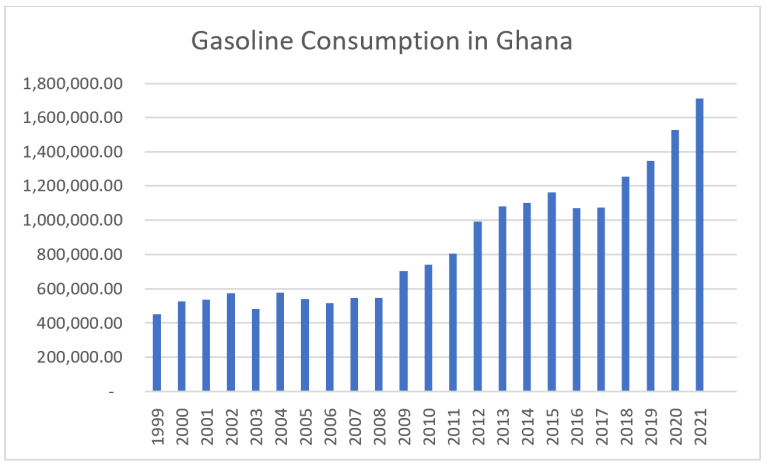

Some crude modelling should make my case. In 2023, Ghana will consume about 2 million metric tonnes of imported refined gasoline (called “petrol” or “premium motor spirit/PMS” in Ghana).

“Imported” because due to insider fighting and perennial horse-trading, the country has struggled to fix its only sub-scale petroleum complex, the Tema Oil Refinery, despite having collected hundreds of millions of dollars in taxes from the population to do precisely that.

Using an unweighted average of “ex refinery” (essentially, “wholesale”) prices quoted by the 23 main fuel importers in Ghana of $4.62 per gallon or, even safer, the $4.06per gallon FOB pricing quoted by the downstream fuel regulator in the June 2022 import window, one can estimate a petroleum import bill of anywhere between $2.9 billion and $3.3 billion per year. (The latest Platts wholesale pricing for gasoline is now in the $3.74 per gallon range).

The government’s plan, at least the bits of it that have been disclosed, calls for the use of 20% of Ghana’s annual gold production by large-scale miners to offset a part of this dollar bill.

According to industry data, gold production in the large-scale sector is in the range of about 2.8 million ounces per year.

The government prefers to use the World Bank’s Commodities Market Outlook database for its price forecasting. The average gold price in the 2023 horizon of this analysis is about $1700.

Therefore, the government’s plan is to buy roughly 560,000 ounces of gold in Cedis at the average USD spot price over a three-month period (full pricing details have yet to be agreed upon with the gold industry). Meaning the Cedi equivalent of roughly $952 million worth of gold will be provided to the local industry by the Ghanaian Central Bank, and the gold will be turned over for refined gasoline (the most economically sensitive fuel) equivalent to about 30% of Ghana’s current total annual needs. In this analysis, we will ignore that further refining may be necessary to meet bullion standards demanded by the ultimate recipients of the gold.

It is not too clear how the actual trading dynamics will work out. The government has effective control over one of the major downstream retailers (the country has about 235 active retailers) called “Goil”. Goil controls about 24% of market volume. One strategy then would be for the government to borrow the roughly 14 billion Ghana Cedis (GHS) needed for the series of transactions described above from the Bank of Ghana. With those funds in hand, it will buy the 560,000 ounces of gold from the large-scale miners, pay the Emiratis or whichever Gulf refiners/traders they have signed up, land the consignments in Ghana’s ports, and then sell to Goil. The final move on the board would then be to pressure Goil to pass all the savings on to consumers, in the hope that competition would force the other retailers to also reduce prices.

It should be clear by now that the plan above, regardless of precise configuration, is fraught with challenges.

First, the large-scale miners today have major overseas payment obligations that lead them to repatriate roughly 20% of their forex earnings to Ghana. The rest is apparently needed for legitimate forex-denominated business expenses. Forcing them, outside these “retention agreements”, to sell 20% of their output in local currency could mean a corresponding and equivalent gap in their forex needs. If so, then, as many analysts have already suggested, they will seek to convert the Cedis received to US dollars. The first goal of relieving US dollar pressures in the forex markets would thus have been defeated.

Second, assuming no or minimal US dollar pressure abatement, the majority of fuel importers will still have to find USD to import 70%, or very likely more, of the required national fuel need. Given that the majority of importers are barely scraping by (a significant number of licensed importers are unable to trade at all, and more than 75% of the fuel is brought in by the 10 largest traders), it is not clear that the rest of the industry will respond to competitive pressure to lower prices even if Goil significantly drop their own prices due to a favourable wholesale price secured through the barter trading.

Third, and more critically, there is no guarantee that the fuel the government procures through this barter arrangement will actually be cheaper than what it can buy on the international market.

For the fuel bought with gold to be cheaper, two assumptions must hold: a) the local Cedi to gold exchange rate must be lower than the Cedi to dollar exchange rate and b) the Gold to oil price ratio (or “exchange rate”) must be lower than the dollar to oil price ratio. Both factors will depend on skilled negotiation, but in a voluntary contracting situation, such as this one, one wonders whether such a double arbitrage will be possible to achieve.

Surely, all gold producers in the world that are net importers of oil would love to exploit these arbitrages. China is both the world’s largest gold producer and oil importer. Yet, despite repeated promises to scale up its gold-backed Yuan-priced oil futures and settlement products, it never seems to find the heart.

Here is a crude summary of why exploiting the three-way arbitrage among local currency, gold, and oil may be harder than it appears at first glance.

Oil and gold prices do not move in tandem. Gold and dollars are however increasingly more correlated than used to be the case. So much so that gold is increasingly a poor hedge against the dollar.

The intriguing joint effect of both facts is the result that Ghana’s plan may in fact be quite risky.

As financial trendspotter, Tim McMahon, has noted, the gold-to-oil exchange rate is fairly volatile.

More importantly, there are more persistent trends in the record of oil being expensive relative to gold instead of the other way around. It is thus very possible that Ghana may have to find more gold for the same amount of contracted oil during significant stretches of the relationship with the Gulf traders.

Here is some simple illustrative math. Suppose at contract sign-off, 10,000 Cedis buys $1000 dollars which in turn buys one ounce of gold. Suppose this amount of gold can buy 10 barrels of oil. Because the gold to oil price ratio is quite stochastic, it could easily so happen that one ounce of gold suddenly only buys 5 barrels of oil on the international spot market. Knowing this, the Gulf traders will insist on linkages to Platts and Argus (international petroleum price intelligence databases often used as a source of price benchmarks) over short windows in order not to be left carrying the can for too long in such a scenario. (Note that we are not even considering the transaction and carry costs involved in the physical handling of gold versus the electronic transfer of dollars.)

Thus, without any significant movement in the dollar – Cedi rate, a subsequent pricing window might require that Ghana must now find 20,000 Cedis to buy $2000 worth of gold if it wishes to maintain the 10 barrels of oil trading volume. In those circumstances, Goil, the assumed retail-end offtake, would find itself completely on the wrong end of the market since its prices would have to double in order to maintain both the peg and its own margins.

It is true that there are legal technologies that can be used in contracts to manage some of these risks (such as options and cross-options), but the Gulf traders/refiners are not daft. They will not consent to an arrangement that consistently disadvantages them. Any extensive use of options (agreements which grant rights but not obligations to buy certain volumes at certain prices at certain times) would likely be symmetrical or come at a cost. “Strategic flexibility” could be offered by options which allow the government to resort to the supply agreement intermittently. In such a context, however, it would work best if the scheme is designed more as a backstop arrangement rather than as the country’s primary source of volumes.

Furthermore, to the extent that the government is introducing another volatility in the pricing chain (the gold-to-oil exchange rate), standard rules of finance will imply higher risk. It is also a cardinal rule of finance that economic actors demand higher margins for higher risk. (For simplicity’s sake we are even ignoring various integrity and institutional risks inherent in abandoning open market transactions for under-the-table, backroom, and negotiations).

All of this raises speculation about the prospect of the government trying to stiff the large-scale miners by forcing them to peg the dollar spot price of gold to a Cedi exchange rate set by the Bank of Ghana. Whilst this will not deal with the gold–oil volatility problem itself, it will seek to moderate the other source of risk: the Cedi – gold exchange rate. Because, if not, then any depreciation of the Cedi against the dollar will immediately reflect in how much the government buys gold for (i.e. in order to maintain the US dollar spot price peg).

Just like the case where the depreciation of gold against oil leads to inflation in the ultimate Cedi amount paid for the oil, a market rate for local gold purchases based on the open market USD rate (which in turn is linked to the dollar spot price of gold) would always result in general depreciation being passed through the local price of gold, which in turn will affect the volumes of gold the government can buy and the resulting barter-volume of oil or gasoline. In simple terms, an unstable chain of pegs.

There is also a further complication regarding the differential pricing of gasoline in the Gulf versus in North-West Europe which may diverge more steeply from underlying crude oil price trends due to faster-rising gasoline price rises in the Gulf compared to the more highly traded North-West markets where Ghana currently obtains its import-parity benchmarks.

But one needs not to go that far to make the central point of this short essay.

And the central point is simply that a successful arrangement to barter gold for oil will not necessarily lead to less Cedi depreciation against the US dollar nor to lower prices at the pump for consumers. Everything depends on the devil in the detail.